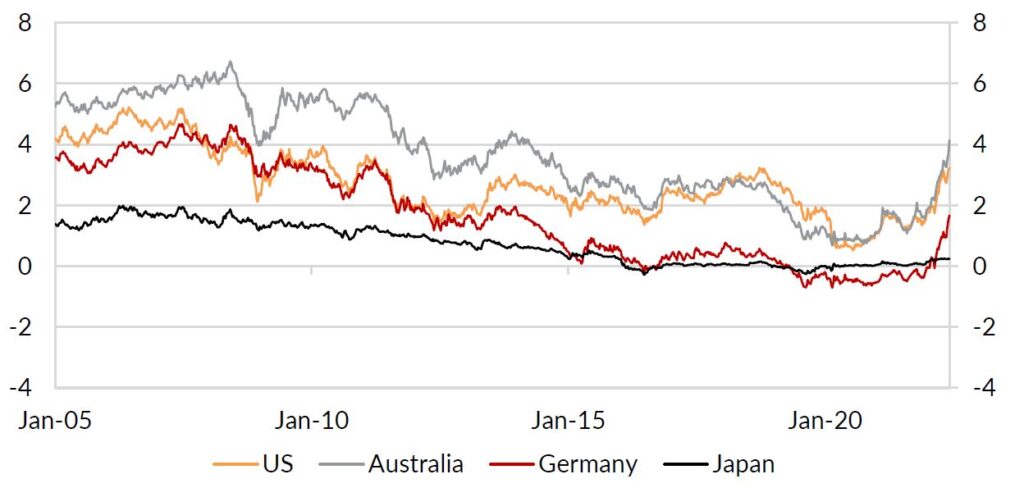

Government bonds have had an extremely difficult start to the year. Inflation has surged around the world. Developed market central banks have been forced to hike rates. Markets have priced in aggressive further rate hikes over 2022. Longer-dated government bond yields have broken higher to levels last seen in 2014 (Chart 1). That has resulted in the worst start to a year for Australian and US government bonds in decades.

Chart 1: Government 10-year bond yields have surged through 2022.

Source: Bloomberg LP, Oreana

The move higher in yields has improved the medium-term returns on offer from government bonds. As a result, we have upgraded our view on the attractiveness of government bonds, as detailed in this month’s Asset Allocation Review.

Bond markets have been in turmoil.

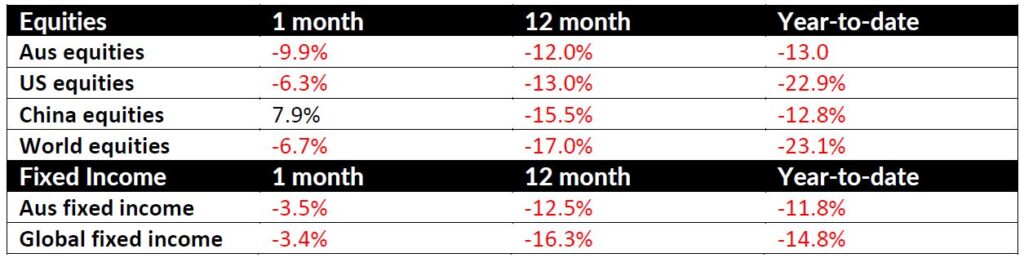

Global fixed income returns have been hammered lower this year (table 1). Markets have priced a sharp increase in policy rates across key markets. That has widened risk premia, increased volatility and pushed yields higher across government yield curves.

Table 1: There has been nowhere to hide in traditional assets in 2022.

Source: Bloomberg LP, Oreana

We expect central banks will deliver further rate hikes. But we are less convinced the US Federal Reserve and the Reserve Bank of Australia will be able to deliver the rate hikes currently priced by the market. In the US, the market expects the policy rate to climb to 3.75% by February 2023. And in Australia, the market expects a similar cash rate by December 2022.

Government bonds have multiple roles in the portfolio.

We believe that government bonds play several roles in a portfolio. These include capital preservation, income, diversification and as a potential downside risk hedge. Bonds can also provide some capital appreciation.

At current government bond yield levels, investors can now access relatively attractive income, as well as gaining downside protection against a recession. This is the first time that has happened in our view since 2019.

Downside protection is increasingly important in a world where a downside “hard-landing” scenario is a growing risk. A hard-landing scenario would likely include a recession. This is not the most likely outcome, in our view, but we think government bonds play an important part in protecting against this outcome.

Shifting our view to neutral.

From a DAA perspective, we have held a Highly Unattractive view on government bonds since July 2021. At that stage, a 10-year Australian government bond had a yield of around 1.10%, while a 10-year US Treasury bond had a yield of around 1.30%. Prospective returns were low over the medium-term. We expected rates would move higher, putting downwards pressure on returns.

The speed of that shift has surprised us. But yields have now moved almost 2.0% higher from when we moved to Highly Unattractive. Risk-adjusted returns now look far less unattractive. As a result, we have upgraded our view from Highly Unattractive to Neutral.

Contact PAS for more information.

The Portfolio Advisory Service has been working with investors across Australia and Asia to help manage investment solutions. This includes a clear move towards managed accounts within the Australian and Hong Kong markets, as well as a focus on investment governance and investment process. The Portfolio Advisory Service can help build custom-made investment solutions including managed accounts, or by providing access to our own range of Active Alpha, Active Beta Plus and Active Beta portfolios. Our work is supported by deep asset class research and manager review expertise within the team – delivering great outcomes for our partners. Reach out to our Portfolio Advisory Service to find out how we can assist you with managing your investment challenges.