Central Bank credibility has been brought into question this year with a sharp acceleration in inflation leaving many policymakers red faced. How could they miss what so many in markets could see months before they acted? Oreana Financial Services’ Isaac Poole is as stunned as anyone, suggesting it not only has eroded trust in these institutions but also increased the risk of an adverse economic shock such as a deep recession. Given the risk that rapid monetary tightening could deliver such as result, Isaac says the investment team have adjusted their investment allocation recommendations accordingly. “We have upgraded our view on US Treasuries at these levels from highly underweight to neutral,” he says. “Longer-dated yields may still move higher, but we think the scope for large increases has reduced.” Isaac says longer durations are now offering reasonable income and attractive downside protection against the Fed doing too much. And while it remains on the nose among many investors, Isaac thinks Chinese equities are looking attractive despite elevated levels of regulatory and economic uncertainty. “We think markets have priced extremely pessimistic outcomes relative to the amount of fiscal and monetary stimulus that can be delivered,” he says. “We remain positive on Chinese equities.”

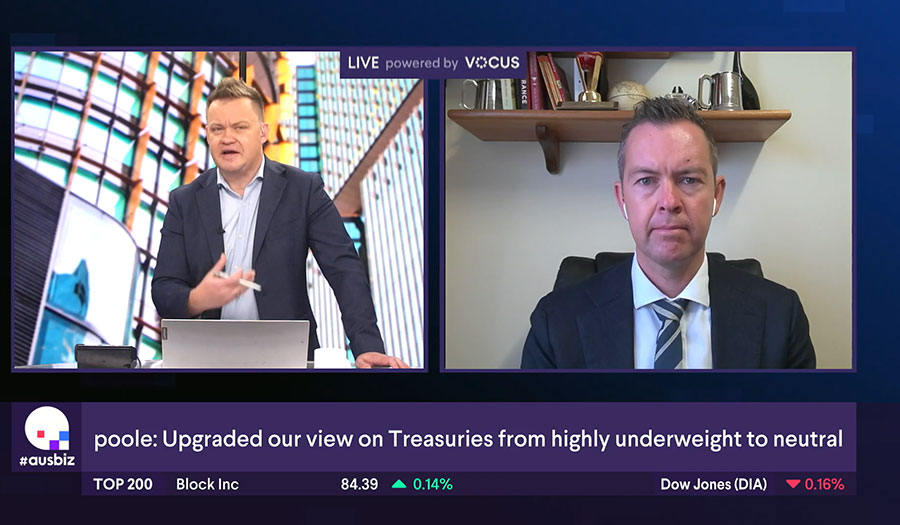

(Source: Ausbiz)

Click here to watch the interview.