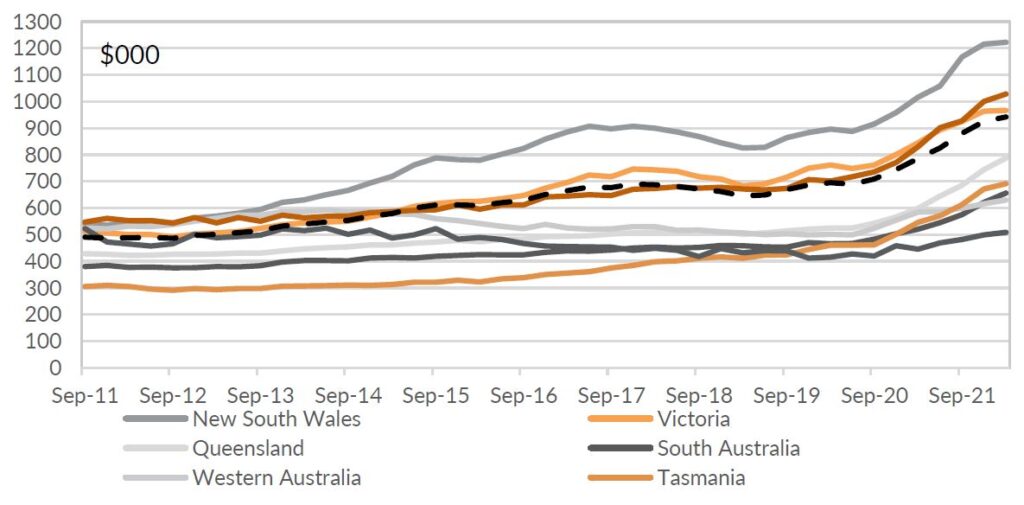

Australia accelerated dramatically since the pandemic. From June 2020 to March 2022, the residential mean price increased 36.6% across the country. Prices are highest in New South Wales, where the average residential price has increased from AUD888,000 in June 2020 to AUD1,222,200 in March 2022. But the biggest increases were seen in Queensland and Tasmania, where prices have increased over 50% over the same 18-month period.

The Reserve Bank of Australia cut rates to a record low of 0.1% in 2020. Cheaper housing loans drove a boom in demand for mortgages. Meanwhile, Australia’s labour market has been relatively resilient. After sharp layoffs in 2020, the unemployment rate remained close to pre-pandemic levels throughout 2021. Lengthy lockdowns, but with a strong labour market, allowed households to ramp up savings for down payments.

The pandemic forced most companies to adopt work from home policies. Although restrictions have eased, the practice has remained, and many companies have moved towards a hybrid model. As a result, in most states, regional prices outside of the capital have increased more than in the capital cities. This is especially the case in New South Wales. House prices in Sydney increased 16.4% from March 2021 to March 2022, while the rest of the state increased by 29.1%.

Chart 1: Australian house prices surged through 2021 but look set to slide in 2022.

Source: Bloomberg LP, Oreana

As the RBA moves to drain liquidity from the market, cash rates and standard variable rates will increase. Prices will fall.

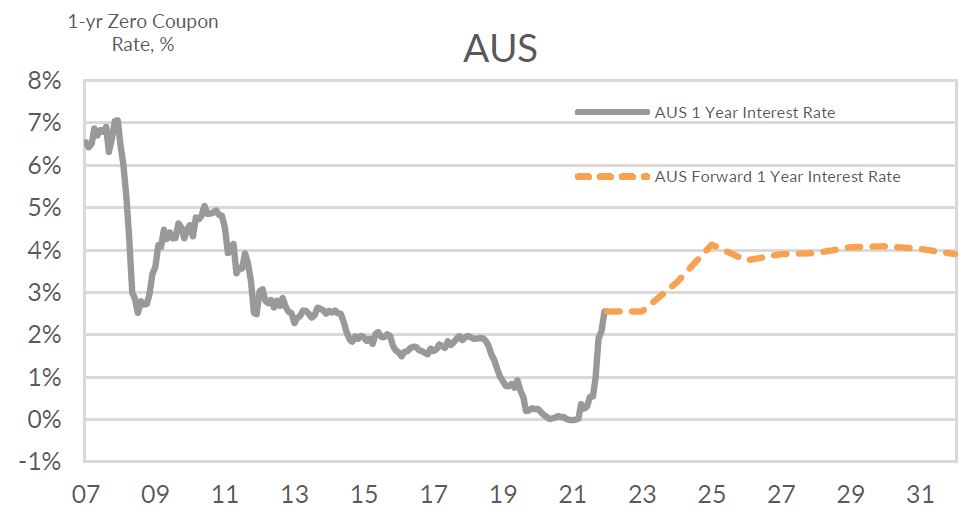

The RBA has estimated that a 2.00 percent increase in interest rates could lower housing prices by around 15% in two years. That would mean a cash rate of 2.15%-2.85%. Current market pricing is well above that by the end of the year. But we do not expect the RBA to hike as fast as market pricing.

Top 5 Questions being asked today

1. Why are house prices falling?

Rising policy rates from 0.10% to 1.35% means mortgages are more expensive, resulting is less demand. After years of record low policy rates, this increased cost is a burden to households.

This additional cost to households is even more pronounced when household finances have already been squeezed. Record high inflation means consumers now have less discretionary income.

House prices probably increased to much due accommodative monetary policy. Record low policy rates and pent-up consumer demand during lockdowns artificially pushed prices to sky highs.

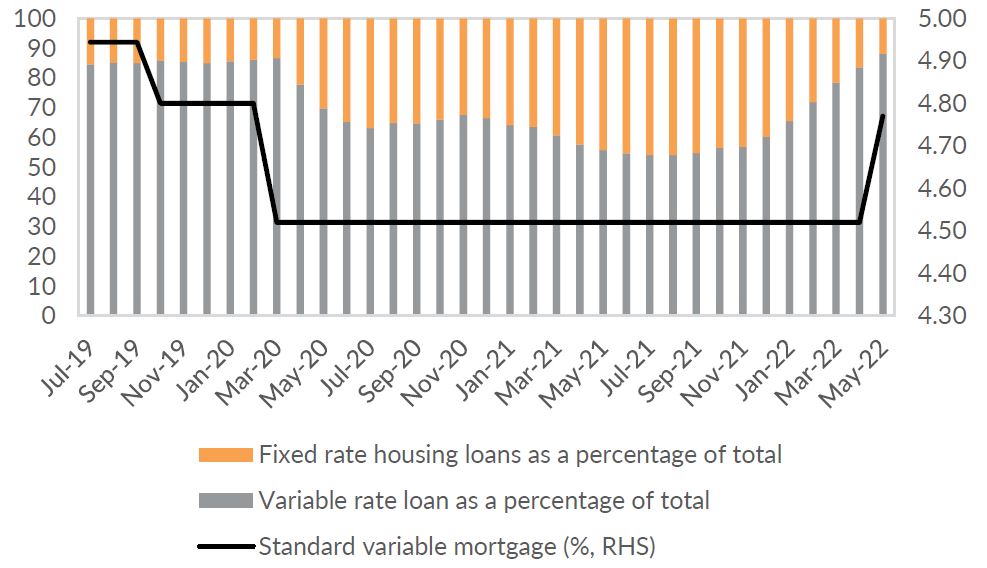

The market is still pricing in further rate hikes to curb elevated inflation. The majority of mortgages in Australia are variable mortgages which are adjusted to the policy cash rate. That means higher policy rates and higher variable mortgage rates will impact most borrowers, putting downward pressure on prices.

Chart 2: Standard variable mortgage rates are increasing – and fixed rates remain a small proportion of total loans.

Source: Bloomberg LP, Oreana

2. How high can interest rates go?

Rate hikes will impact inflation through demand, wages and house prices. Central banks want to lean against this type of inflation. They have limited control over supply side inflation – the rise in food, commodities and energy as a result of Covid19 and the Ukraine war.

Rate hikes also operate with a lag. This can be between 6 and 24 months. Central banks will want to hike enough to ensure they are controlling inflationary pressure through 2023, but not so much they cause a recession. Rates will go higher than the 1.35% and 1.75% currently in Australia and the US. But we think they will not go so high as the markets have predicted this year.

Chart 3: Markets are pricing a sharp increase in cash rates in Australia.

Source: Bloomberg LP, Oreana

3. How far could house prices fall?

Historically, the Australian housing market has been rather resilient to recessions. During the recession in the early 1990s, house prices continued to rise. During the Global Financial Crisis, when Australia avoided a technical recession, prices fell briefly but recovered quickly.

But credit availability has a distinct correlation with the housing market. Given aggressive monetary tightening by the RBA, we think there is a near-term downside of between 10% and 20% peak-to trough.

But we do not think the outlook is disastrous over the medium-term. There will be support from immigration picking up and years of underbuilding. These are structural supports that will help home prices from 2024 onwards. But the RBA hiking less than the market expects is a cyclical impact that we expect will prevent house prices declining more than 20%.

4. What is the risk of a recession in Australia?

There is a very narrow landing strip for central banks to achieve a “soft landing”. Central banks have almost always caused a recession when they hike rates. But it is possible to achieve a soft-landing for a period of time. A soft landing would involve:

- rates moving higher, albeit less than markets are pricing,

- inflation moving back towards central bank targets, around 2.5%,

- growth slowing to around trend, and

- jobs growth slowing from elevated levels.

The most likely alternative scenario is a hard landing. A hard landing would cause a recession over the next 18 months. A hard landing is a scenario where:

- rates move above market expectations,

- inflation remains elevated for a period of time,

- growth falls below trend, and

- the unemployment rate moves higher from current low levels.

The decline in equities is a signal that investors currently expect around a 50% chance of a recession over the next 18 months. We think that probability is too high. In Australia, the economy is enjoying a strong terms of trade boost thanks to elevated commodity prices. The unemployment rate is at historic lows. We think there is less stress than the media and many commentators predict – leaving the Australian economy some way off a recession.

5. What is the implication for portfolios?

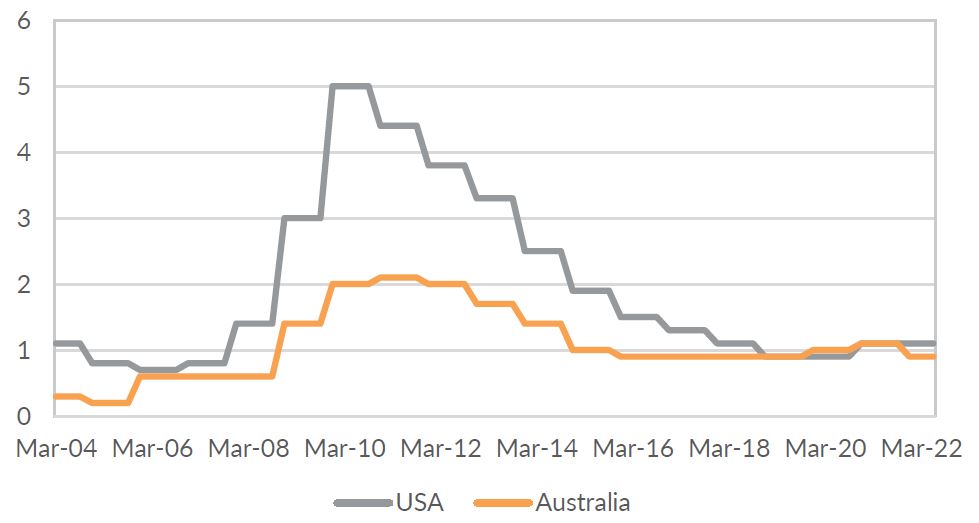

Lower house prices will likely lead to lower wealth for home-owners and less income for potential investors. There may also be a risk of rising non-performing loans for banks and a reduced credit supply – although this would be rising off a low base. Given lower income and wealth, earnings may fall as households and businesses reduce their spending.

Chart 4: Non-performing loans account for less than 1% of total bank loans in Australia.

Source: Bloomberg LP, Oreana

All else being equal, lower house prices are clearly a risk to the economy and equity market returns. But not all is equal – we expect the RBA will not hike to recession. And it is happening at a time when the terms of trade are booming, providing a big transfer of wealth to Australia from overseas. As a result, we are less pessimistic than the market.

A short sharp draw down, but light at the end of the tunnel?

The RBA is increasing the cash rate. It is likely to adjust back toward more normal levels compared to the 0.1% in place over the past two years. That will impact house prices. House prices will fall after the historically rapid pace of house price growth since 2020. We do not expect the RBA will hike rates as quickly or as high as the market is pricing. That means expectations for a housing-led recession, or deep declines in house prices, will probably be confounded. Instead, we expect house prices will suffer some peak to trough declines before beginning to recover in the medium-term.

There are risks around this view. A recession is possible. But markets have moved to price this risk in. And the RBA, while talking tough on inflation, is clearly reluctant to damage its credibility further by delivering a recession after hiking rates too late. On balance, we expect this to be an orderly move to lower house prices in the near-term before prices begin to recover over the medium-term.

Contact PAS for more information.

The Portfolio Advisory Service has been working with investors across Australia and Asia to help manage investment solutions. This includes a clear move towards managed accounts within the Australian and Hong Kong markets, as well as a focus on investment governance and investment process. The Portfolio Advisory Service can help build custom-made investment solutions including managed accounts, or by providing access to our own range of Active Alpha, Active Beta Plus and Active Beta portfolios. Our work is supported by deep asset class research and manager review expertise within the team – delivering great outcomes for our partners. Reach out to our Portfolio Advisory Service to find out how we can assist you with managing your investment challenges.