Inflation will remain too high. The Fed will hike too fast. The US economy needs to enter recession.

So goes the overwhelming consensus among Wall Street analysts. The move to that consensus coincided with a brutal H1 2022 for diversified portfolios. Equities fell as central banks hiked and bond yields surged. We saw global positioning shift to be underweight equities and underweight duration. This reflected many investors moving to a more defensive positioning ahead of a widely anticipated recession.

We disagree with the consensus. A US and global recession is not inevitable. It is a clear risk – if the US Federal Reserve decides to force market pricing for aggressive rate hikes down the throat of a US economy that is simply not able to chew fast enough to digest them. But our central view is that the Fed will pause. It will hike rates through 2022, then pause in 2023 to gauge the impact of a cooling economy and slowing inflation.

And we expect that will be enough to extend the economic cycle, in contrast to the consensus view.

Downside risks abound

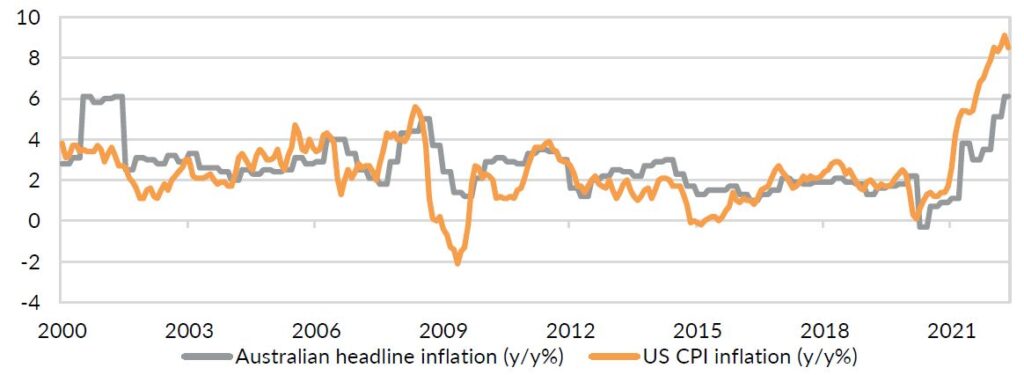

Risk is a skewed to the downside currently in a way that cannot be ignored. Growth is slowing. The Fed is hiking. And inflation remains stubbornly high (Chart 1). The risk of a policy error from the Fed is considerable. And that risk is near-term. The US economy has already suffered two consecutive quarters of negative growth. Further rapid hikes in interest rates could be enough to drag the economy into a true recession.

Chart 1: Inflation remains stubbornly high in the US and Australia.

Source: Bloomberg LP, Oreana Portfolio Advisory Service

Disinflationary pressures persist in the medium-term

While downside risks abound, we do not agree with a growing view that inflation will prove to be secular rather than cyclical. Inflation has broadened out somewhat as supply chains have remained disrupted, energy and food prices are elevated, and the labour market has proven resilient. But the overwhelming secular trends of debt and demographics have not been overcome. We think that as rates move higher in the US – and we expect the Fed Funds rate will increase to around 3.25%-3.50% this year – inflation will fall faster than markets have priced. And that will allow the Fed to implement a pause that extends the cycle.

How do we gauge recession risk?

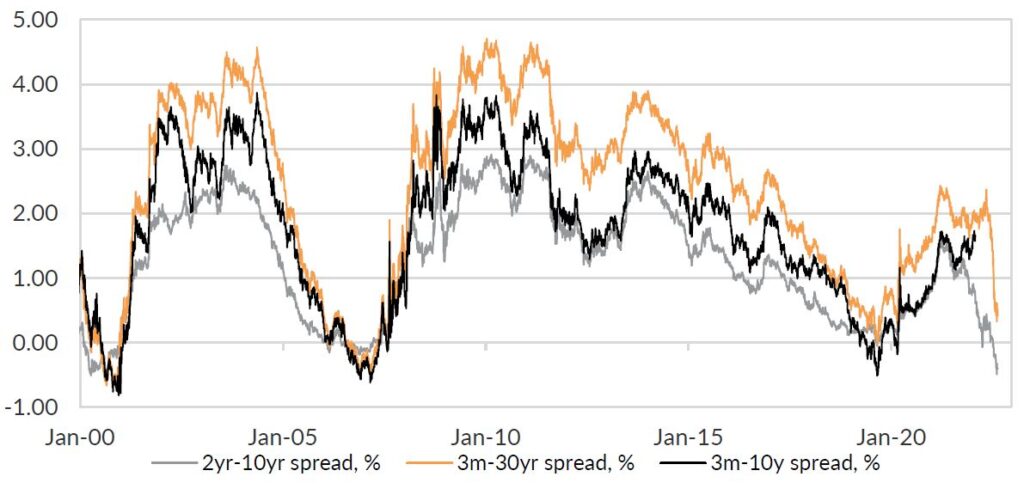

Some measures of the US yield curve – including the difference between the 10-year and the 2-year Treasury yield – have already inverted (Chart 2). Another measure – the difference between the 30-year Treasury yield and the Fed Funds rate – is not inverted. Inverted yield curves historically have been a warning signal for a recession. But this has a variable lead time. It could be months. It could be years. From our perspective, a recession is likely to start when the yield curve normalises. That will happen as the market prices immediate rate cuts from the Fed, a sure sign that the economy has turned.

Chart 2: Parts of the US yield curve have inverted, signaling recession is a clear risk.

Source: Bloomberg LP, Oreana Portfolio Advisory Service

Other indicators include the weekly jobless claims, unemployment, consumer and business sentiment, consumer spending, and business investment. These are sending mixed signals. That indicates slowing growth, but not recession. We continue to monitor these as uncertainty persists.

What have we done to manage recession risks?

In June, longer-dated US Treasury yields and Australian government bond yields surged to the highest levels in almost a decade (Chart 3). We shifted our rating to neutral and added government bonds to our managed account portfolios. We think this position will play an important role in managing risk over the medium-term.

We expect the Fed will have to cut rates if there is a recession. That will push yields lower. Government bonds will provide downside protection, diversification and capital preservation in this environment.

Chart 3: Government bond yields reached a peak in June but have since drifted lower.

Source: Bloomberg LP, Oreana Portfolio Advisory Service

We think longer-dated government bond yields will drift lower if there is not a recession. This will happen because the Fed hikes less than the market has priced, and inflation proves to be less persistent than the consensus expects. Portfolios will benefit from capital gains (bond prices increase as yields move lower) and diversification.

We have not materially changed our gross exposure to international and US equities. We acknowledge the recent rally has benefited from a move lower in yields. We think that can persist. We also expect earnings over the coming year will surprise very negative expectations on the upside. But we have adjusted our style exposure to provide a moderately higher exposure to quality value within our portfolios.

Avoid knee jerk reactions

Markets were incredibly difficult to navigate through H1 2022. The temptation to make knee jerk reactions to significant market movements was high. For strategic asset allocation investors, a belief in the power of diversification was tested as both bonds and equities experienced significant drawdowns. For dynamic asset allocation investors, the risk of being whipsawed by markets was high. These periods drive home the importance of a robust governance framework, a documented set of investment beliefs, and credible, transparent communication. We think these will continue to be critical in the months ahead as volatility and uncertainty remain elevated.

Contact PAS for more information.

The Portfolio Advisory Service has been working with investors across Australia and Asia to help manage investment solutions. This includes a clear move towards managed accounts within the Australian and Hong Kong markets, as well as a focus on investment governance and investment process. The Portfolio Advisory Service can help build custom-made investment solutions including managed accounts, or by providing access to our own range of Active Alpha, Active Beta Plus and Active Beta portfolios. Our work is supported by deep asset class research and manager review expertise within the team – delivering great outcomes for our partners. Reach out to our Portfolio Advisory Service to find out how we can assist you with managing your investment challenges.