Sell equities, buy bonds. Government bonds in particular. Absolutely get some shorter-dated maturities into the portfolio. But right now, you should consider adding duration. I know, I wrote in May that it was a good time to add short duration. And it still is. But with US 10-year Treasury yields selling off to above 4.75%, longer maturities are looking interesting again.

Inflation is falling.

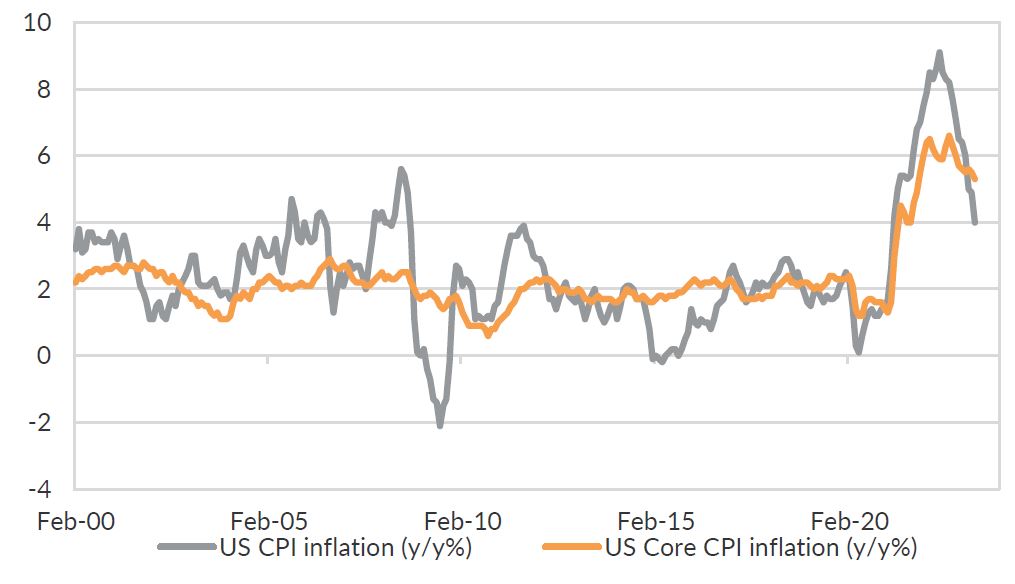

Headline inflation in the US is not just falling. It is collapsing. The focus has been on the somewhat stickier core inflation. Yes, core inflation has more inertia. But it has a history of following the lead of headline inflation.

Chart 1: Core inflation follows headline inflation lower.

Source: Bloomberg LP, Oreana Portfolio Advisory Service

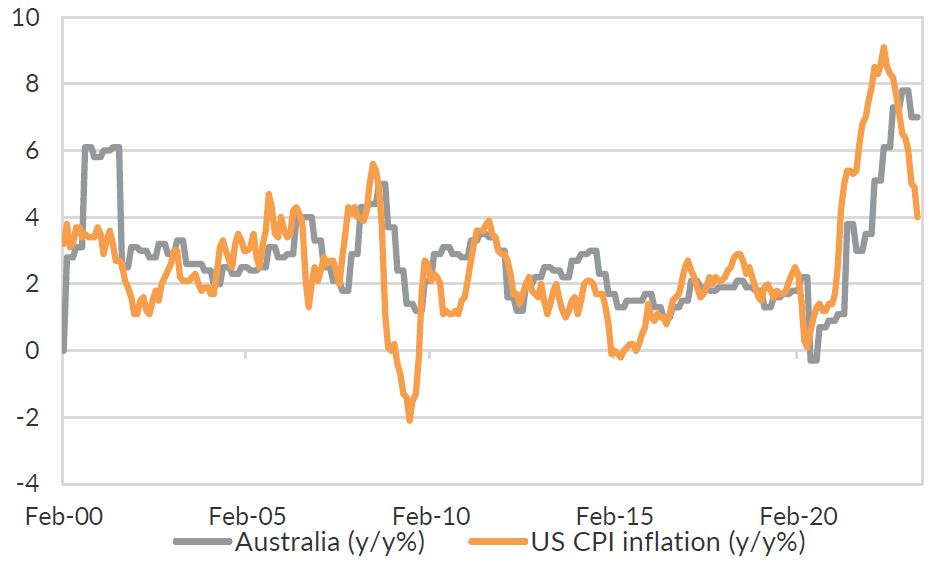

For what it is worth, Australian inflation tends to follow US inflation lower too. Yes, there are idiosyncratic differences. But I expect the direction for travel for inflation is lower over the next six months.

Chart 2: Australian inflation tends to follow US inflation lower.

Source: Bloomberg LP, Oreana Portfolio Advisory Service

Falling inflation will cap longer-dated government bond yields.

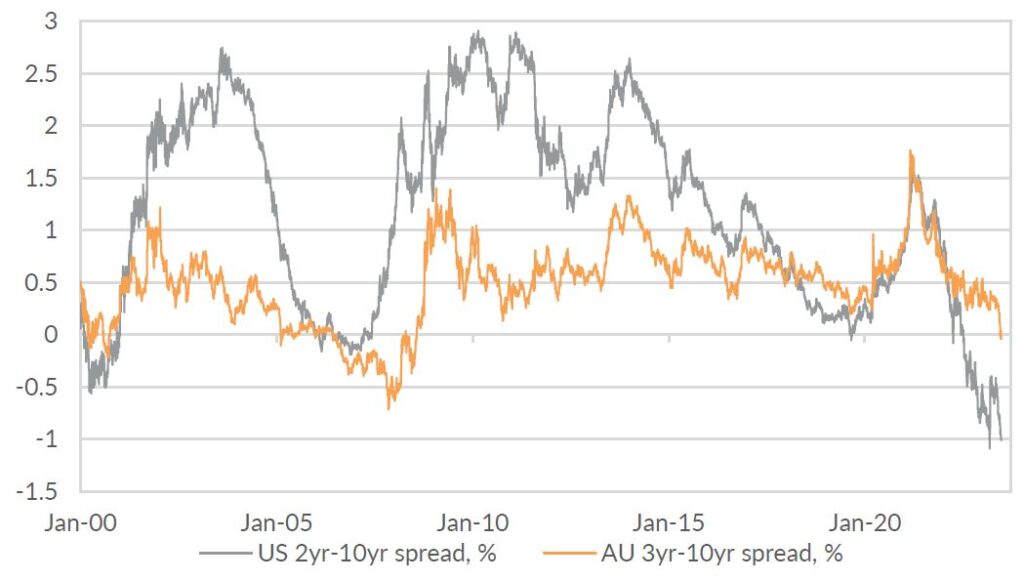

The path lower for inflation has capped longer-dated government bond yields. The US Treasury yield curve is now inverted. So is the Australian government bond yield curve. Part of that is the compression of inflation premium.

Chart 3: Australian and US yield curves have inverted.

Source: Bloomberg LP, Oreana Portfolio Advisory Service

But it is also increasingly reflecting a compression in term premium. Bond markets are screaming at central banks that the very tight monetary policy settings will cause a recession. And force significant rate cuts. Who can blame the bond market for this view? In the US, the manufacturing PMI is a whisker away from recessionary levels at 45. Initial jobless claims are rapidly moving higher. Consumer confidence is rock bottom. Recession is coming.

But not yet.

Recessions typically take 6-15 months to arrive after the last rate hike. That means sometime in 2024, assuming we are 1-2 hikes away from the RBA and the Fed pausing. There are a lot of good indicators for when a recession begins. One of those is the yield curve normalising. Chart 3 shows we are some ways from that. But it could happen by year-end. And between now and then, we are going to see some deteriorating economic data.

Bad news is bad news.

There comes a time in every economic cycle where bad news is simply bad news. The prospect for a rate pause or pivot ceases to be a driver of positive sentiment. Instead, the reality that recession is creeping nearer weighs on investors animal spirits.

We are not there yet. That means we have time to prepare for that inevitability. The next several months are likely to reflect a typical end-of-hiking cycle. Equities will grind higher, without conviction. Downside vulnerabilities and risk will grow. How can investors build resilience and robustness into multi-asset portfolios? Put simply: sell equity, buy government bonds.

Fade the rally.

US and Australian equities have rallied through 2023. But this is a narrow rally. Tech stocks have driven the rally. Ex-tech, the market looks somewhat less appealing.

I’m not saying go out and sell all equity exposures. But the recent rally is an opportunity to lighten up exposure to those surging tech and AI stocks.

Add duration.

We had been advocating adding shorter duration since March, when 2-year Treasury yields were around 5.00%. It has been a round trip since the banking disasters in the US. Locking in high yields and downside protection still looks a sensible move in hindsight.

Longer-dated Treasury and Australian government bond yields have also had a round trip from around 4.00%, down to around 3.25%, and back up again. That has been more volatile given the increased interest rate sensitivity.

I think central banks are now at the end-game. Hikes will soon give way to a pause and then cuts. 10-year yields around 4.00% are again offering an attractive combination of yield and downside protection with significant capital gains if (or when) central banks begin to cut rates.

Prepare now and prevent panic later.

The economic outlook the US and Australia in the near-term is one where the economy slows gradually before snapping to recession in 6-12 months. That provides an opening for US and Australian equities to grind higher. But make no mistake about it, we are near the end of this economic cycle. And when the cycle ends, investors who have not prepared will find themselves rushing for the exit with every other investor. That way leads significant capital loss and volatility. Prudence suggests investors should begin preparing now by reducing equity beta and adding government bonds, including longer-dated maturities, to build resilience and downside protection.

Contact PAS for more information.

The Portfolio Advisory Service has been working with investors across Australia and Asia to help manage investment solutions. This includes a clear move towards managed accounts within the Australian and Hong Kong markets, as well as a focus on investment governance and investment process. The Portfolio Advisory Service can help build custom-made investment solutions including managed accounts, or by providing access to our own range of Active Alpha, Active Beta Plus and Active Beta portfolios. Our work is supported by deep asset class research and manager review expertise within the team – delivering great outcomes for our partners. Reach out to our Portfolio Advisory Service to find out how we can assist you with managing your investment challenges.